Silver, often referred to as “Silver Prices Future Forecast” has always held a unique place in the world of precious metals. While it shares some attributes with gold as a store of value and hedge against inflation, silver also boasts significant industrial applications, particularly in technology and green energy. This dual demand often leads to fluctuating prices, making the forecasting of silver’s future value both complex and intriguing. In this article, we will explore factors influencing silver prices, recent trends, and expert predictions for the future.

1. Historical Trends in Silver Prices

The price of silver has historically exhibited periods of sharp increases followed by corrections, often tied to broader economic trends, market sentiment, and shifts in industrial demand. For example:

- The 1980s Spike: In 1980, silver prices surged due to the Hunt brothers’ attempt to corner the silver market, briefly reaching nearly $50 per ounce before crashing.

- The 2011 Peak: The aftermath of the 2008 financial crisis spurred a run on precious metals, with silver once again reaching close to $50 in 2011 as investors sought safety.

Since then, silver prices have seen moderate volatility, generally ranging between $15 and $30 per ounce. The COVID-19 pandemic brought new interest in silver, with prices peaking around $30 in 2020, driven by uncertainty and supply chain issues.

2. Key Factors Influencing Silver Prices

Forecasting silver prices involves understanding a variety of market and macroeconomic factors. Here are some of the most significant:

- Economic Uncertainty and Inflation: Like gold, silver is often seen as a hedge against inflation and currency depreciation. During periods of high inflation, investors tend to flock to precious metals, including silver, driving prices higher.

- Interest Rates: The value of precious metals often inversely correlates with interest rates. When rates are low, the opportunity cost of holding non-yielding assets like silver decreases, making it a more attractive investment.

- Industrial Demand: Silver has extensive industrial applications, especially in electronics, solar panels, and electric vehicles (EVs). As demand for these products grows, so too does the industrial demand for silver.

- Supply Constraints: Silver production is heavily influenced by mining output, which can be affected by factors like geopolitical instability, labor issues, and environmental concerns. Supply constraints can create upward pressure on prices.

- Renewable Energy and Green Technologies: With the shift toward clean energy, the demand for silver is expected to grow, especially in solar technology and electric vehicles. Both require silver for their photovoltaic and electrical properties.

3. The Impact of Geopolitical Tensions and Global Economic Conditions

The global economy is currently facing a period of uncertainty, influenced by several geopolitical and economic challenges. Tensions between major economies, such as the United States and China, can impact the global supply chain, affecting the availability of silver. Additionally, the ongoing Ukraine crisis has added volatility to the energy and commodity markets, indirectly impacting the demand for precious metals like silver.

Moreover, emerging market economies, where silver consumption is typically high, are experiencing currency depreciation and inflation, affecting their purchasing power. This could lead to fluctuations in silver demand as well, impacting its price trajectory.

4. The Role of Central Banks and Monetary Policies

Central banks have a direct influence on precious metals markets. For instance, when central banks enact quantitative easing (QE) or keep interest rates low to stimulate the economy, it generally results in weaker fiat currencies and higher inflation. This scenario tends to benefit silver as a store of value, driving up its price.

Conversely, if central banks begin to tighten monetary policy to curb inflation, as we’ve seen in recent interest rate hikes by the U.S. Federal Reserve, it can apply downward pressure on silver prices. Investors then move towards assets that offer higher yields, such as bonds, rather than non-interest-bearing assets like silver.

5. Silver Price Forecast for 2024 and Beyond

Many industry analysts and financial institutions provide forecasts for silver prices based on economic indicators, supply-demand analysis, and market sentiment. Here are some predictions for 2024 and the coming years:

- Short-term Outlook: In the short term, silver prices are likely to remain volatile. With central banks focused on combating inflation, higher interest rates may temper gains in the silver market. However, if inflation persists longer than expected, there may be renewed interest in silver as a hedge.

- Medium to Long-term Outlook: Over the next five to ten years, the demand for silver is expected to increase, particularly due to its role in green energy technologies. Some experts predict that silver prices could gradually trend upward, with estimates ranging between $30 and $50 per ounce by 2030, as global energy policies prioritize clean energy, bolstering industrial demand for silver.

- Potential for New Highs: If global economic instability intensifies, some analysts believe silver could retest its all-time highs. However, this is highly contingent on external factors such as geopolitical stability, inflation rates, and industrial demand growth.

6. Silver vs. Gold: Comparative Performance and Investment Strategies

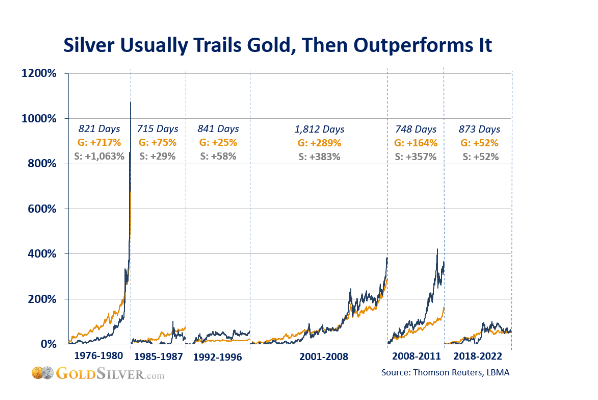

While silver and gold share similarities as precious metals, their market dynamics differ. Silver’s industrial demand makes it more susceptible to economic cycles compared to gold, which is predominantly a monetary metal. This means silver is generally more volatile, offering greater potential for returns but also increased risk.

For investors, a diversified approach might include both gold and silver, balancing the stable value retention of gold with silver’s growth potential, especially in periods of economic expansion and industrial demand growth. Silver ETFs, physical silver, and futures contracts are popular ways to gain exposure to silver’s price movements.

7. Conclusion: Navigating Silver’s Complex Future

The future of silver prices depends on a complex interplay of macroeconomic trends, industrial demand, monetary policy, and technological advancements. As silver continues to play a critical role in green technologies and electronics, its value proposition is likely to strengthen. However, the influence of inflation, interest rates, and central bank policies will continue to cause short-term volatility.

For investors, understanding silver’s dual role as a precious and industrial metal is key to making informed decisions. Those seeking stability may prefer gold, while those willing to embrace some risk for higher potential returns may find silver to be an attractive option. As we look toward 2024 and beyond, silver remains a valuable asset in both traditional and modern investment portfolios, with future growth closely tied to the global economy’s direction and the accelerating shift towards renewable energy